3 Hidden Profit Leaks Most Landlords Don’t See (Until It’s Too Late)

3 Hidden Profit Leaks Most Landlords Don’t See (Until It’s Too Late)

After managing rental properties for over 12 years, I’ve seen just about everything — from the good tenants who treat your home like their own, to the ones who think “rent due on the first” means “maybe by the fifteenth.”

But there are three hidden profit leaks that quietly eat away at your bottom line, and most landlords don’t even realize how much money they’re losing until they do the math.

Let’s break them down 👇

💧 Leak #1: Vacant Days Between Tenants

Every day your property sits empty, you’re not just losing rent — you’re losing momentum.

A few extra days here and there might not seem like much, but if your rental sits vacant for even 20 days a year, that’s nearly 6% of your annual income gone.

Most of the time, vacancies drag on because of:

- Poor timing on marketing (waiting until move-out to list)

- Slow turnover repairs or cleaning

- Inflexible showing schedules

Fix it:

Start advertising the moment your current tenant gives notice. Have a professional photographer shoot the property once — and reuse those images every time. And if possible, pre-approve your next tenant before the old one moves out.

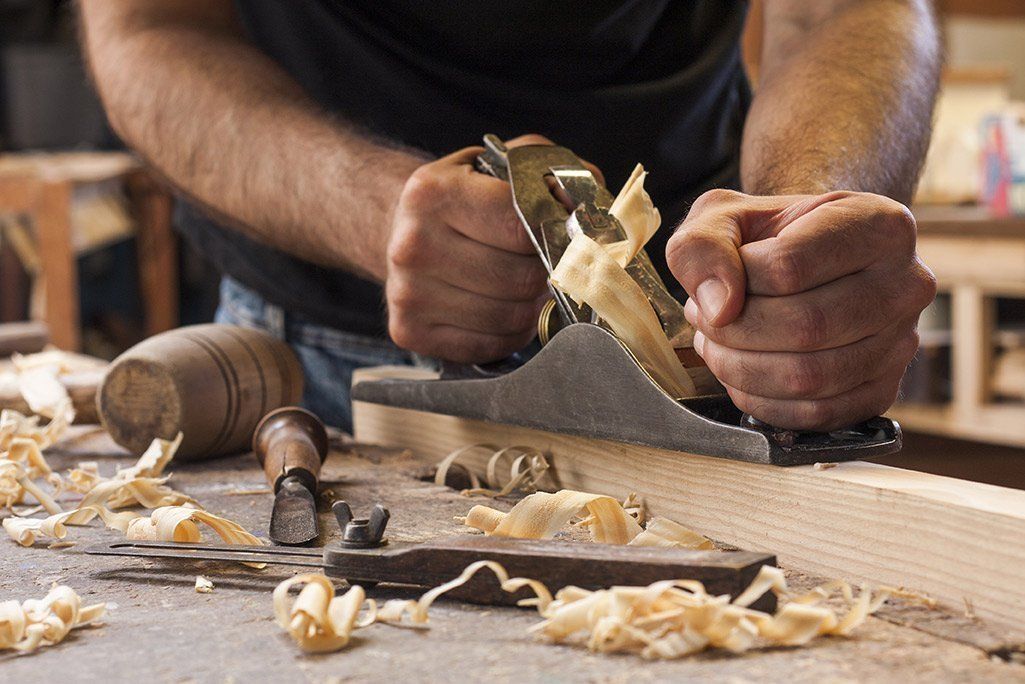

🔧 Leak #2: Emergency Maintenance Calls

Ever get that 2 a.m. “my toilet’s overflowing” call? Those aren’t just stressful — they’re expensive.

Emergency calls often come with:

- After-hours surcharges

- Rush fees for parts or labor

- Reactive (not preventative) repairs

Fix it:

A proactive maintenance schedule can cut emergency calls in half. Seasonal inspections (especially before winter or hurricane season) help you catch small issues before they become urgent.

For example, replacing a $25 supply line now can prevent a $2,500 flood later.

💰 Leak #3: Under-Market Rent Pricing

It’s easy to fall behind market rates — especially when you’ve had a “good tenant” who’s been there for years.

But keeping rent below market might cost you thousands annually.

Fix it:

Do a market rent analysis at least once a year. Compare similar properties in your area, not just by square footage — but also amenities, updates, and neighborhood demand.

Even a modest $75 monthly increase (still fair market) equals $900 more per year — per property.

🚀 The Bottom Line

Landlording can be profitable — if you treat it like a business.

The key is being proactive, not reactive:

- Minimize vacancy days

- Stay ahead on maintenance

- Keep rents aligned with the market

At BIG Realty Management, we help property owners plug these profit leaks — often turning underperforming rentals into true income producers within a single lease cycle.

If you’re curious how much your property could really earn, request a free rental performance audit today.